gearing corporate finance

When there is a high proportion. As the debt and equity can take a different form such as short-term debt form working capital the gearing ratios also vary.

According to the Appendix 3 the gearing ratio of Matrix Concept Berhad from 2018 to 2019 were at 1501 and 1507 separately.

. Financial gearing refers to the relative proportions of debt and equity that a company uses to support its operations. Commonly gearing is termed as debt financing against equity financing. These methodsof finance thus increase shareholder risk.

Then more money is borrowed against the shares to establish a margin loan that can be used to purchase even more shares. Gearing is a measure of a companys debt against equity. Double gearing refers to the practice of borrowing money against an asset with the money being used to buy shares of stock.

Gearing ratios are a group of financial metrics that compare shareholders equity to company debt in various ways to assess the companys amount of leverage and financial stability. A company with more equity is termed as a low geared company as it does not have a high liability of paying off fixed interest or dividends. The gearing ratio measures the proportion of a companys borrowed funds to its equityThe ratio indicates the financial risk to which a business is subjected since excessive debt can lead to financial difficulties.

According to the gearing ratio of Matrix Concepts Holding Bhd Matrixs gearing ratio in 2019 is 1507 and had slightly increased to 1614 in 2020. Gearing refers to the relationship or ratio of a companys debt-to-equity DE. However the gearing ratio of Matrix had reduced to 1165 in 2021 by reducing long-term debt.

What is the Gearing Ratio. What is Double Gearing. This situation is due to the range of equity increased 2071 less than the long-term debt 2923.

This information can be used to evaluate the risk of failure of a business. Gearing Ratio The gearing ratio is a financial ratio that compares the amount of money borrowed by a firm to the amount of money it owns IG nd. Higher debt means a higher gearing or leverage of a company.

Tether USDT Is Gearing up To Reveal a Historical Development in Around 3 Weeks as per a Tweet by the Companys CTO Bitchcoin Home Tether Tether USDT Is Gearing up To Reveal a Historical Development in Around. Optimal capital structure This was previously covered in. Capital Gearing Ratio It is a ratio showing the relationship of the company between the owners funds and external funds with fixed payout commitments.

Gearing shows the extent to which a firms operations are funded by lenders versus shareholdersin other words it. Gearing measures the debt used to finance the underlying firms operations versus the shareholders capital received. A high gearing ratio indicates a high proportion of debt to equity whereas a low gearing ratio shows a low proportion of debt to equity.

Gearing Debt and preference shares give rise to fixed payments that must bemade before ordinary shareholder dividends can be paid. A high gearing ratio represents a high proportion of debt to equity while a low gearing ratio represents a low proportion of. In other words the metrics signify the mix of funding from lenders and from the shareholders.

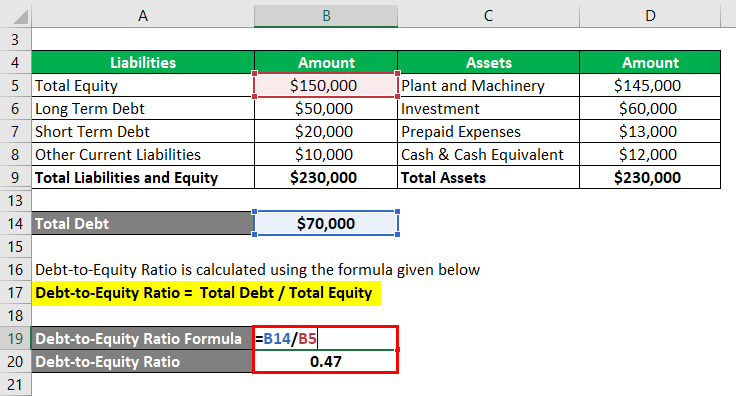

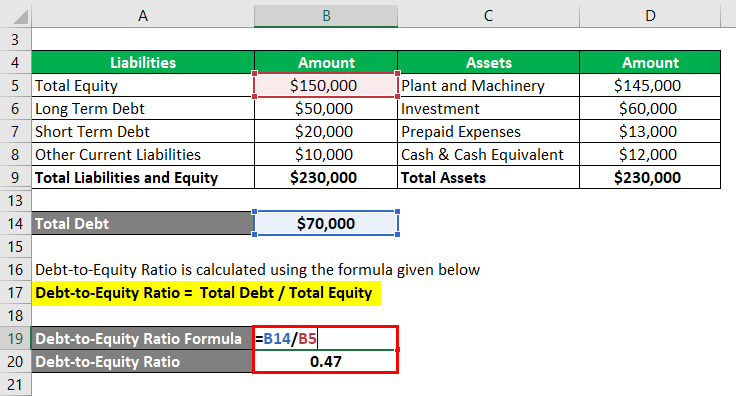

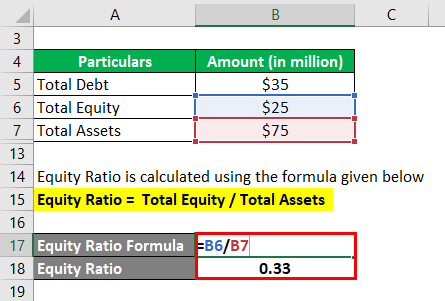

In short double gearing is a form of leveraged investing. The term gearing refers to the group of financial ratios that demonstrate to what degree are the operations of a company funded by debt financing vs equity capital. There are three major gearing ratios Debt-to-Equity Ratio Equity Ratio Debt Ratio.

Gearing Formula How To Calculate Gearing With Examples

Gearing Guide Examples How Leverage Impacts Capital Structure

What Is A Gearing Ratio Definition Formula And Calculation

Gearing Formula How To Calculate Gearing With Examples

Belum ada Komentar untuk "gearing corporate finance"

Posting Komentar